Page 9 - Baltimore County 2022 Quality of Life Guide & Business Directory

P. 9

New co-working spaces are ideal locations for startups and innovators. (More information about incentives and workspaces is on page 12.)

Eastern Baltimore County is home to Tradepoint Atlantic, a 3,300- acre global logistics center that features unmatched access to deep-water shipping berths, railway lines and national highway arteries. Major employers like Amazon, BMW, Home Depot and Under Armour have leased or built space at Tradepoint, creating thousands of new jobs.

But Baltimore County is not only a thriving place to grow a business — it’s also a terrific place to live. Excellent public schools, renowned institutions of higher education, and beautiful parks and natural areas add up to an unbeatable quality of life

for the people who make our vibrant economy work. World-class hospitals and their primary and specialty care affiliates are located throughout the county.

If you choose to join us, rest assured that we at the Baltimore County Chamber of Commerce are working closely with Baltimore County government and private stakeholders to ensure that all businesses thrive.

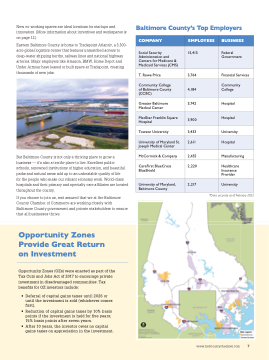

Baltimore County’s Top Employers

COMPANY

EMPLOYEES

BUSINESS

Social Security Administration and Centers for Medicare & Medicaid Services (CMS)

15,415

Federal Government

T. Rowe Price

3,764

Financial Services

Community College of Baltimore County (CCBC)

4,184

Community College

Greater Baltimore Medical Center

3,742

Hospital

MedStar Franklin Square Hospital

3,900

Hospital

Towson University

3,433

University

University of Maryland St. Joseph Medical Center

2,611

Hospital

McCormick & Company

2,455

Manufacturing

CareFirst BlueCross BlueShield

2,220

Healthcare Insurance Provider

University of Maryland, Baltimore County

2,217

University

*Data accurate as of February 2022

Opportunity Zones Provide Great Return on Investment

Opportunity Zones (OZs) were enacted as part of the Tax Cuts and Jobs Act of 2017 to encourage private investment in disadvantaged communities. Tax benefits for OZ investors include:

• Deferral of capital gains taxes until 2026 or until the investment is sold (whichever comes first).

• Reduction of capital gains taxes by 10% basis points if the investment is held for five years; 15% basis points after seven years.

• After 10 years, the investor owes no capital gains taxes on appreciation in the investment.

www.baltcountychamber.com 7