Page 10 - Georgia Forestry - Issue 1 - Winter 2024

P. 10

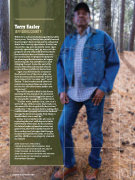

Terry Easley

Jeff Davis County

While he’s only actively managed his land for three years, Terry Easley has quickly learned that Georgia’s harvest tax can be a financial drain for forestry operations. Easley has owned his 195-acre property since 1997, actively operating only 45 acres of the property as row crop land until he made

the decision to harvest timber on a 111- acre tract in 2020. To prepare the property for planting and reforestation, he began harvesting the few suitable trees and chipping the rest. Come the end of the year, he found himself stunned when he received three tax bills for the harvest.

“I got a tax bill from the county for the harvest tax of the trees, plus one from the state and one from the federal government for income tax,” said Easley. “I don’t understand how they can tax you so many times on a harvest, let alone at all before it even makes you any money.”

Those bills made a dent in his future planning for the operation. He now must assess how he should juggle the costs of the sustainable management of the forest.

“Unlike with income tax, you can’t write off any of those costs that it takes to take care of the forest against the harvest tax,” said Easley. “The amount they’re taking, that could be used to properly reforest the land and manage the forest sustainably. Now I have to decide what I can or can’t do.”

Easley is currently in the process of replanting the tract, with hopes to finish by February of this year. As he considers the future burden of taxation on his next generation, who will reap the benefits of the next harvest, he hopes that Georgia leaders will rectify the issue so that he and his children can properly steward the land. �

JOHN CASEY IS A STRATEGIC COMMUNICATIONS PROFESSIONAL WHO SUPPORTS CLIENTS THROUGH THE ART OF STORYTELLING. IN HIS DOWNTIME,

JOHN CAN BE FOUND HUNTING AND FISHING ON HIS FAMILY’S CENTENNIAL FARM IN NORTHWEST GEORGIA.

8 | GEORGIA FORESTRY

MIKE GREGORY / GFA